Possible causes of Parsing Errors

Published: 9/12/2023

You likely reached this page after seeing an error like the following when trying to paste data into the ssa.tools calculator:

Data Paste

ssa.tools accepts a copy and pasted earnings record from the Social Security Administration's website. The box that you paste this into immediately updates after you paste data into it, no submit button press is required.

However, in order to be parsed correctly, the data must be in a format the site understands. This site accepts pasted data from different browsers and operating systems. However, it's possible there are still a few formats that are unknown and not yet supported.

If you've looked through the tips in this document and still think something is broken, please don't hesitate to reach out!

Common Errors

A few common issues that sometimes cause issues with the input include:

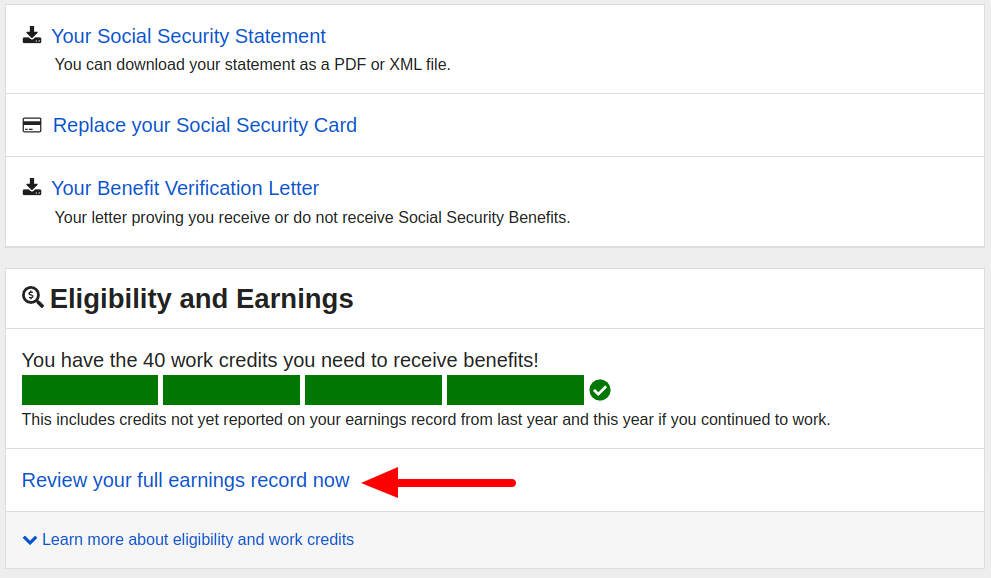

Copying data from the wrong place.

There is only one place on the ssa.gov website where you can find your earnigns record. Once logged in, you should see a page like the following with a link to "Review your full earnings record now:"

Alternatively, after logging in you can also go directly to https://secure.ssa.gov/ec2/eligibility-earnings-ui/earnings-record.

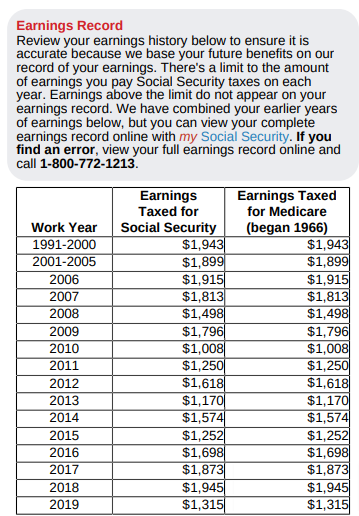

Copying data from your PDF Social Security Statement

The Social Security Administration also provides a PDF version of your earnings record. On page 2 of the PDF is a table with an abbreviated version of your earnings record that looks like the following:

ssa.tools does accept this format as well, however it isn't as precise. If you notice, the first few rows are not individual years, but rather ranges of years. This means that the earnings for each year in the range are averaged together. This is not as precise as the data from the ssa.gov website.

Other Formats

Some people copy data from their own spreadsheets or similar records. If you do this, ssa.tools will accept most formats. Some things to keep in mind that will make this easier:

- Each year's record should be one line.

- The first column should be the year.

- The second column should be the taxed earnings for social security.

- You can leave additional columns, they will be ignored.

- Separate columns with any whitespace: tab, spaces, or multiple of each.

- Commas (,) and Dollar Signs ($) are allowed but not required.

An example of this format is:

2015 $5,000

2014 $4,000

2013 $3,000

2012 $2,000

2011 $1,000